Payroll Confirmation

Payroll confirmation is a methodology that provides greater flexibility for institutions to comply with the compensation compliance requirements of the federal government. Traditional effort reporting was a methodology that calculated the amount charged to a project as a % Effort (or Time equivalency) that would be confirmed by the individual as being accurate. This method may be confusing in instances where faculty may have expended a % of time above the amount that was charged to the project (for a variety of research or budget management reasons). Payroll confirmation is a methodology that is better aligned to the compensation regulations that were changed in the Uniform Guidance (UG) and issued by OMB. Under Payroll confirmation, the PI, by project, can confirm salary charged to a project does not exceed the value of the work/time performed for the project. This change in methodology should also provide for a significant reduction in faculty and administrative burden for this required process to confirm the accuracy of salary charged to the federal government.

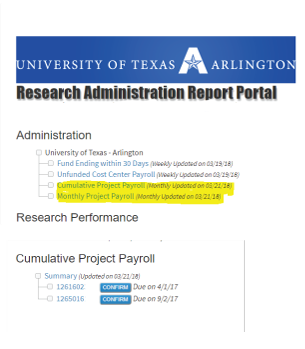

UTA has a system of internal controls to help ensure compliance in accordance with UG § 200.430 -Compensation. These internal controls rely in part on the periodic review of Monthly Project Payroll reports to help ensure interim charges and budget estimates for payroll are reasonably accurate for the work being performed. The Cumulative Project Payroll report documents the PI(s) After-the-Fact Review to confirm the payroll charges for the work performed on a project does not exceed their proportionate share of their Institutional Base Salary (IBS). This action confirms that the final amount charged to the federal government is accurate (e.g. Annual or Final financial and progress reports).

|

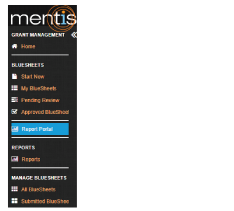

1. PIs are asked to review payroll expenses monthly (but not less frequently than quarterly). Monthly Project Payroll reports are available in mentis for all projects that were active 3/1/2017 or later. These reports are informational to help illustrate the allocation of salary for the individuals charged to your project and do not require confirmation |

|

2. Once a year on the project anniversary date, PIs are asked to view the Cumulative Project Payroll report and confirm that the payroll amount direct charged or cost shared to the project is less than or equal to the amount of work performed (proportionate share of IBS). Since our last effort certification period with ecrt ended 2/28/2017, some Cumulative Project Payroll reports will be confirming payroll for a partial year, dependent upon the project end date. You can view Monthly and Cumulative Project Payroll reports in Mentis. |