Payroll Confirmation

What Is Payroll Confirmation?

Payroll confirmation is an after-the-fact review process designed to ensure that salary charges to federally funded projects comply with government regulations. Specifically, it:

- Documents the PI’s review to confirm payroll charges align with the actual work performed.

- Ensures payroll expenses do not exceed the individual's proportionate share of their Institutional Base Salary (IBS).

- Applies to all non-hourly payroll charged to sponsored projects.

- Confirms that the final salary amount charged to the federal government is accurate and allowable.

Why Is It Required?

This process is required to ensure compliance with federal regulations, specifically:

2 CFR 200.430 – Compensation: This regulation mandates institutions must have a system for reviewing compensation to ensure that all charges to federal awards are reasonable, allocable, and properly documented.

When Does It Happen?

|

Frequency |

Activity |

|

Monthly (at least quarterly) |

PIs are expected to review payroll charges regularly for accuracy. |

|

Annually |

PIs must review and confirm the Cumulative Project Payroll report on the project anniversary date. |

PI Responsibilities

- Review payroll charges monthly (at minimum quarterly) to ensure appropriateness.

- Work with your department administrator to identify and resolve any inaccurate or inappropriate payroll charges or cost share issues.

- Annually confirm the Cumulative Project Payroll report by reviewing salary distribution for all personnel and certifying if it is accurate.

- Do not certify if the data appears inaccurate—initiate corrections instead (see “What to Do if Payroll Is Incorrect”).

Monthly Payroll reports

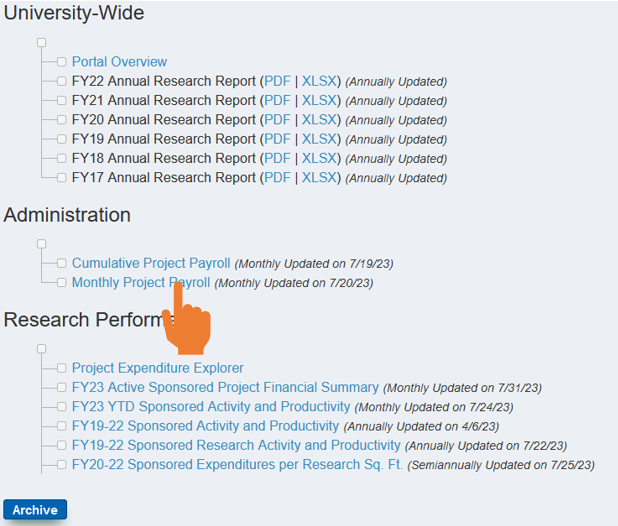

How To Access

- Click on Monthly Project Payroll.

- Select the appropriate project to review payroll details

How to review Monthly Payroll – Key Considerations

- Does the salary charged to the project reasonably reflect the work performed?

- Does the salary charged not exceed the individual’s IBS for the effort contributed?

- Are all allocable and appropriate personnel charged to the correct project or cost share account?

- If applicable, is salary over the NIH cap correctly allocated to the appropriate cost share account?

If any discrepancies are found, contact your department administrator immediately to process corrections for both interim and future charges.

How to access

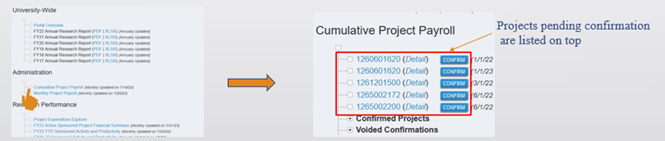

To Access Cumulative Project Payroll (Annual Review):

- You’ll receive an automated email approximately 45 days before the project anniversary.

- The email contains a direct link to the payroll report requiring review.

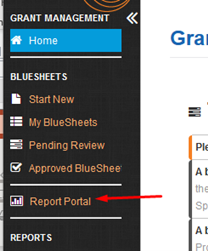

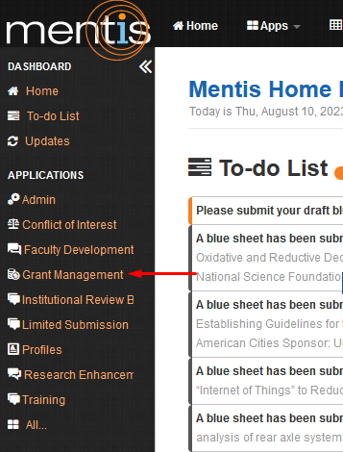

- Alternatively, access via Mentis:

Grant Management → Report Portal → Cumulative Project Payroll

![]()

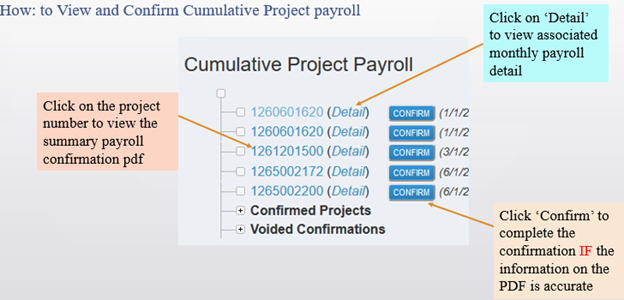

How to review

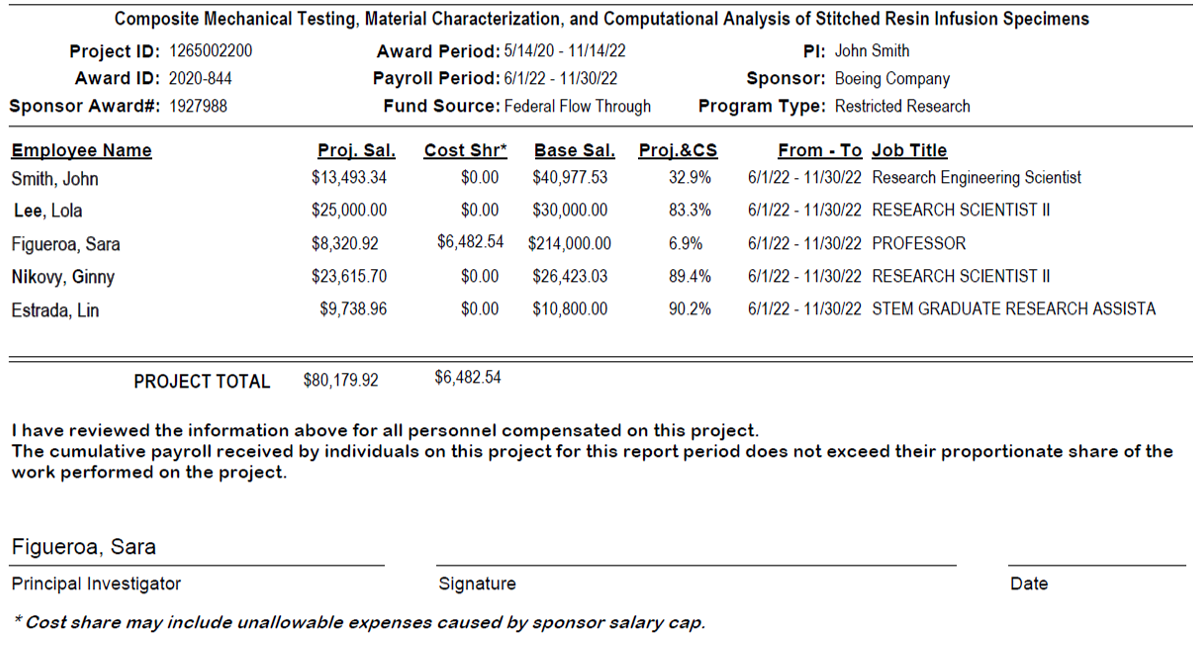

- Review project salary and cost share salary for each individual.

- If needed, click ‘Detail’ to view monthly payroll breakdowns.

- If the distribution accurately reflects effort and IBS, click ‘Confirm’ to certify the report.

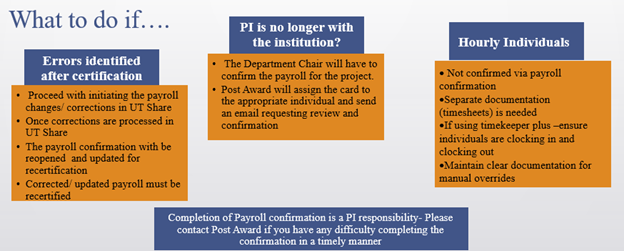

Mentis Report Is Incorrect, but UT Share Is Correct

- Do not confirm the report in Mentis.

- Notify your Department Admin to review and verify against UT Share.

- If UT Share payroll is accurate, provide the payroll discrepancies to PostAward.

- PostAward will work to correct the Mentis card. Once corrected, the PI can log in and confirm.

UT Share Payroll Is Incorrect

- PI and Department Admin must request payroll correction through the institutional financial/payroll system.

- Once corrected in UT Share, notify PostAward.

- PostAward will then update the Mentis card.

- PI can proceed with certification after correction is made.