Budget Management

Internal Award Set Up

Once an executed award or official NOA is received, the OGCS award setup specialist collaborates with the PI to finalize the Bluesheet, budget, and cost share details (if applicable) before initiating the award setup in UT Share.The award setup specialist establishes the award in UT Share and sends out the New Award Distribution Email. This New Award Distribution Email is sent to the PI, department, and Grant Accounting and will include:

- NOA or contract document

- Assigned project number

- The award and budget are set up under a UTA-assigned project number (126XXXXXXX) based on the final approved budget.

- Cost share account information (if applicable)

- Dedicated cost share cost centers are established to track and separate cost share budgets and expenses.

- Subaward information (if applicable)

- Summary of Key Terms and Conditions

- Includes any special terms and sponsor contact details.

Once setup is complete, the award is handed over to the PostAward Office for ongoing management. For inquiries regarding award setup status, contact ogcs@uta.edu.

PI Budget Responsibilities

PIs are responsible for the financial stewardship of their sponsored projects. A few key responsibilities PIs should perform while monitoring their sponsor projects are, but not limited to:

- Initiate expenditures and complete monthly reviews of account statements.

- Ensure expenditures are directly allocable to the funded SOW and are:

- Incurred solely to advance the work under the sponsored agreement.

- Benefiting the award in proportions that can be approximated through reasonable methods.

- Necessary and assignable to the award.

- Ensure all expenses are reasonable and necessary to accomplish the project goals:

- Reflecting what a prudent person might pay.

- Ensure all expenses are allowable within institutional and sponsor guidelines.

- Expenditures should be charged in a timely manner and within the awarded period of performance.

- Spend within the obligated award amount.

- Review and approve subaward invoices:

- Confirm associated subaward work was performed adequately.

- Follow all applicable University policies and procedures, such as those for travel, purchasing, employment (HR), contracts, and compensation (payroll).

- Ensure that all committed cost-sharing is appropriately expensed to the cost share cost center.

- Notify PostAward of anticipated changes to budget needs and request budget transfers and cost transfers in a timely manner.

Allowability of Costs

To determine whether an expense is allowable, consider the following:

- Compliance with Regulations

Does the expense adhere to:- Sponsor guidelines

- Uniform Guidance (2 CFR 200)

- Sponsor/Award-specific terms and conditions

- Federal Acquisition Regulations (FARs) (if applicable)

- Institutional policies and guidelines

- Guide to Allowable Costs

- Sponsor Restrictions

- Are there any sponsor-imposed restrictions that would make this expense unallowable?

- Necessity and Budget Alignment

- Is the expense necessary for the completion of the awarded project?

- Was the expense budgeted for in the submitted and awarded budget and budget justification?

- Cost Share and Duplication

- Has this expense been included as a cost or used to meet cost-sharing requirements of another federal award?

- If yes, the expense is not allowable.

- Has this expense been included as a cost or used to meet cost-sharing requirements of another federal award?

- Documentation

- Is the expense adequately documented to support allowability and compliance?

Allocability of Costs

Allocability on sponsored projects refers to the ability to assign costs to a specific sponsored project or activity in a manner that accurately reflects the benefit received by that project.

- Salary and cost share allocations must reasonably reflect the effort performed on the project and must not exceed the individual's Institutional Base Salary (IBS) allocation for the work conducted.

- If an expense is beneficial to multiple projects or activities, it must be appropriately allocated across those projects in proportion to the benefit received.

- A project should never be charged for more than its allocable share of an item, expense, or service.

Reasonableness

"Reasonableness" in the context of a sponsored project means that costs charged to the project must be appropriate, justifiable, and reflect prudent decision-making given the nature and circumstances of the project. An expense is considered reasonable if it is neither excessive nor extravagant and aligns with what a prudent person would pay for a similar item or service under comparable conditions.

When assessing the reasonableness of costs on a sponsored project, consider the following factors:

- Market Prices – The cost should align with typical prices for similar goods or services in the marketplace.

- Scope of Work – The cost must be necessary and directly related to the project’s approved objectives and activities.

- Industry Standards – The cost should be consistent with prevailing practices in the relevant industry or research field.

- Institutional Policies – The expense must comply with institutional policies, sponsor regulations, and any guidelines set by the funding agency.

- Benefit to the Project – The cost should provide a clear and direct benefit to the project, contributing to its successful completion.

Direct vs. Indirect Costs

Direct Costs

According to 2 CFR 200.413, direct costs are those that can be specifically identified with a particular final cost objective, such as a federal award or other funded activity. These costs must be assigned consistently and accurately across similar circumstances.

A direct cost benefits a specific grant or contract explicitly for a programmatic purpose. Examples include:

- Salaries, wages, and fringe benefits

- Materials and supplies

- Equipment

- STEM tuition

- Travel

Indirect Costs (Facilities & Administrative, F&A)

Per 2 CFR 200.411, indirect costs (IDC) are incurred for common or joint objectives and cannot be readily assigned to a specific project. These costs support the University’s infrastructure and include:

- Facilities Costs – Expenses related to buildings, such as depreciation, capital equipment, maintenance, and utilities.

- Administrative Costs – General institutional expenses, including accounting, human resources, libraries, and purchasing.

Indirect costs are charged as a percentage of direct costs based on the applicable awarded indirect cost rate. If a sponsor limits the University’s full IDC rate, certain costs typically considered indirect may be directly charged to the project, if allowable.

Charging Direct and Indirect Costs

- Direct costs should be allocated to the appropriate budget category of the project.

- Indirect costs are charged at the awarded indirect cost rate as direct costs are incurred.

The University collects and distributes indirect costs according to its established policies. For more details, visit the Office of the Provost’s policy page to review the IDC Distribution Plan.

Upon receiving the distribution email with the award setup details, promptly review the budget and Bluesheet to identify your immediate expenditure needs. Communicate these needs to your department administrator as soon as possible to ensure timely processing and avoid delays in expenditure activities.

Salary/Payroll

To ensure salary expenses are charged correctly to your award, follow these steps:

- Review the intended budget and budget justification.

- Assess current personnel and identify needs.

- Communicate any payroll changes, updates, or new appointments with your department administrator.

- For cost share or salary cap, ensure the correct cost center is used, and expenses are appropriately applied.

When requesting payroll updates, provide your administrator with:

- Project Number - 126XXXXXXX

- Employee Name – Individual to be paid from the project.

- Time Period – Specify whether payment is for summer or academic year.

- Effort Allocation – Include percentage effort, especially if split across multiple projects.

- Cost Share or Salary Cap Considerations – Clearly indicate:

- The amount and period to be charged to the cost center.

- The amount and period (if applicable) to be charged to the project.

Changes in Effort

If you anticipate an extended absence from your project, such as a sabbatical, medical leave, or any other period of reduced availability, even if you intend to remain engaged remotely, please notify postaward@uta.edu in advance. This allows PostAward to conduct a compliance review and ensure that sponsor requirements regarding effort commitments and project oversight are met.

For federal awards, sponsor prior approval is required before:

- PI or Co-I disengages from the project for more than three months.

- PI or key personnel reduce their effort by 25% or more.

- Replacing a key person identified in the award.

Keep in mind that different sponsors may have varying policies regarding absences, changes in effort, or delegation of responsibilities. To ensure full compliance, all prior approval requests, including those related to extended absences, changes in key personnel, or significant project modifications, must be submitted to postaward@uta.edu for review and processing before contacting the sponsor.

Salary Cap

Some funding agencies set a salary cap, which limits the maximum salary an individual can receive from their awards.

-

Examples of agencies with salary caps include:

- Department of Health & Human Services (DHHS)

- Health Resources & Services Administration (HRSA)

- Cancer Prevention & Research Institute of Texas (CPRIT)

Current Salary Cap Example (DHHS, 2024)- DHHS salary cap for budget periods starting 01/2025: $225,700

- UTA treats salary over the cap as cost share.

- The IBS used for calculating salary charges cannot exceed the cap.

Example:- Dr. ABC’s 12-month IBS: $250,000

- Effort committed to a DHHS award: 20%

- Only 20% of the $225,700 cap ($45,140) can be directly charged to the project.

- The remaining portion ($4,860) must be covered by a non-federal cost center.

Salary Cap Calculation- Institutional Base Salary – Sponsor Salary Cap = Excess Salary Charged to Cost Center

- $250,000 – $225,700 = $24,300 (excess salary over cap)

- Excess Salary x Effort % = Salary Cap Cost Share

- $24,300 x 20% = $4,860 (charged to cost center)

- Cap Salary x Effort % = Allowable Salary on Project

- $225,700 x 20% = $45,140 (charged to project)

Salary Cap Roles & Responsibilities: PI/Key Personnel/Department ResponsibilitiesCommunicate salary cap needs early—preferably at the time of requesting direct salary expenses—to ensure accurate budgeting, avoid delays in award setup, and allow time for identifying appropriate cost-sharing sources. Early coordination with the PostAward team helps ensure that any salary over the cap is properly documented and covered by non-sponsored funds, in compliance with sponsor and institutional policies.

Be sure to work with administrators to ensure:

- Salary exceeding the cap is not charged to the project.

- The correct salary cap cost center is used.

- Notify PostAward if:

- An individual’s effort allocation changes.

- An IBS change affects salary cap calculations.

- Plan ahead for summer salary cap charges:

- Discuss with the department in advance.

- Confirm cost center funds are available.

Salary Cap Roles & Responsibilities: OGCS ResponsibilitiesOGCS staff play a critical role in ensuring adherence to sponsor-imposed salary caps throughout the grant lifecycle. Below are the roles outlined for the OGCS staff regarding salary cap.

Award Setup Specialist:

- Reviews salary caps during award setup.

- Creates the necessary salary cap cost center.

- Documents salary cap details in the distributed blue sheet.

PostAward Team:

- Reviews salary cap calculations when processing award increments.

- Communicates cost share information in the distribution email.

Supplemental Pay

Supplemental pay is generally unallowable under federal awards. It is only permitted if it is:

- Specifically included in the federal award budget, or

- Explicitly approved in writing by the federal awarding agency before payment.

If seeking for approval of supplement pay, then Approval Requirements Requests for supplemental pay must provide clear evidence that:

- The service is essential and cannot be performed by personnel already funded by the grant.

- The charge is reasonable, considering the consultant’s qualifications, standard rates, and the nature of the work.

- The sponsor has explicitly approved extra compensation for these services.

Supplemental pay is not allowed if the faculty member is listed in the proposal and/or budget as a project investigator or senior/key personnel. Additional/supplemental pay circumvents the UTA payroll confirmation- The PI and department must maintain appropriate documentation (timesheets, etc.).

Intra-University Consulting

Faculty consulting within UTA is typically considered part of their institutional duties and does not qualify for additional compensation unless all of the following apply:

- The consultation is across departmental lines or involves a separate or remote operation.

- The work is above and beyond the faculty member’s regular responsibilities.

- Additional compensation is explicitly included in the federal award or has received written approval from the federal awarding agency.

- All three criteria must be met for supplemental pay to be allowable.

Cost Sharing (Matching Funds)

What is Cost Share?

Cost sharing (or matching) occurs when multiple organizations contribute to funding a project. Typically, an external sponsor funds part of the project, while the University covers the remainder.

General Guidelines:

- Confirm cost share source with the award setup specialist before award setup.

- Charge cost share expenses to the correct cost share cost center using the appropriate speed type.

- Cost transfers should not be used as a way to manage cost share expenses.

- Cost share follows the same allowability rules as direct salary expenses charged to the project, meaning expenses must be:

- Allowable

- Allocable

- Reasonable

- Cost share expenditures, budget transfers, and cost transfers require the same level of oversight, review, and justification as project expenses.

- All committed cost share must be incurred by the award’s end date.

- Cost share expenses must be documented and verifiable.

Restrictions on Cost Share

- Expenses unallowable on the main award cannot be used as cost share.

- Cost share commitments cannot be reduced or eliminated at will—once committed, cost share is required by the funding agency, regardless of whether it was mandatory or voluntary in the proposal.

- Salary cap costs are unallowable and cannot be used as a required cost share.

- Expenses charged or committed to one federal award cannot be used as cost share on another federal project.

Salary Cost Share

- Negotiated at the proposal stage and documented in the award budget.

- Outlined in the awarded "blue sheet" at project setup.

- PostAward handles reviews and modifications once the award is active.

- PI effort not directly charged to the project may require cost share documentation and must receive UTA approval.

- NIH Reporting: PI effort must be reported in the NIH RPPR participant section.

Best Practices

Promptly charge cost share to the appropriate cost center to maintain compliance with sponsor and institutional requirements. Delays in recording cost share can lead to discrepancies in financial reporting and potential audit findings. Additionally, ensure that all effort and expenses committed as cost share are accurately tracked, documented, and supported with appropriate records. This includes maintaining time and effort certifications, internal documentation, and financial system entries that clearly reflect the cost share commitment. Proper tracking is essential for meeting reporting obligations and withstanding audits by sponsors or internal reviewers.

APS form

The APS (Authorization for Professional Services) form is used to compensate individuals for short-term or sporadic services, including:

- Other services: Analysis, consulting, evaluation, or similar professional services.

- Participant stipends.

- UTA employees when duties are outside their regular employment or across departmental lines (prior approval may be required).

Salary supplements are generally unallowable on sponsored projects and cannot be paid through the APS process. Before initiating salary-related expenses, contact PostAward@uta.edu unless the individual is explicitly named and approved in the awarded budget.

Processing Payments

- Work with your department administrator to complete and submit the APS form.

- Submit payments promptly – Delays beyond 90 days after services are rendered will require additional justification.

Key Considerations for Completing the APS Form

- Project & Account Codes: Enter the Project # along with the G4XXX number or associated account code in the “Cost Center/Project ID #” fields.

- Service Description: The “Description of Service” field must align with the corresponding cost item in the awarded budget justification. It should be detailed and clear.

- Prior Approval for Unbudgeted Services: If the service was not included in the budget justification, contact PostAward before services are provided to determine allowability and any necessary prior approvals.

M&O, Equipment, and Travel

Work with your department administrator to ensure that all expenses charged to the project are allowable, allocable, and reasonable in accordance with sponsor guidelines and institutional policies. This includes verifying that each cost directly benefits the project, is necessary for its completion, and is properly documented.

Additionally, Purchase Orders (POs) exceeding $5,000 will automatically route to PostAward for prior review and approval before processing. This review helps ensure compliance with sponsor terms, budget limitations, and procurement regulations. To avoid delays, initiate large purchases early and provide supporting documentation as needed.

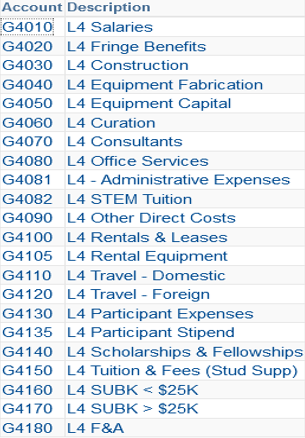

G4010 - Salaries

- Covers all IBS for Key Personnel (PI, Co-PI) and other UTA employees/students charged to the project.

- Overtime compensation or salary supplementation is generally unallowable—confirm with PostAward before processing.

- Student salary payments must align with similar student positions within the department.

G4020 - Fringe Benefits

- Fringe benefits are charged in proportion to the associated salary expenses. Budgeted rates:

- Faculty/Staff/Research Associate/Post Doc: 30%

- Graduate Research Assistants/Graduate Teaching Assistants: 20%

- Undergraduate Students/Part-time/Employee Consulting: 8.3%

Note: These are estimated rates; actual expenses are charged as incurred.

G4030 - Construction

- Applies only to construction awards/projects.

G4040 - Equipment Fabrication

- Includes non-expendable items under $5,000 used to assemble a stand-alone piece of equipment valued at $5,000 or more.

- Fabricated items are permanently attached and cannot be used separately from the main unit.

- All fabricated items must be tagged as a single unit upon completion.

- Expense Account: 87101 (must be used for all fabrication purchases, regardless of cost).

- Unallowable: Normal repair, maintenance, expendable supplies (e.g., toner, grease, glue).

- Prior approval may be required per sponsor guidelines.

- UTA Equipment & Fabrication Procedure

G4050 - Equipment Capital

- For stand-alone equipment purchases valued at $5,000 or more with a useful life exceeding one year.

- Freight and installation costs are included in acquisition costs.

- Upgrades/Improvements:

- Must exceed $5,000 and/or increase the original equipment’s value by ≥25%.

- The upgraded component retains the same inventory tag as the original item.

- Prior approval may be required per sponsor guidelines.

- UTA Equipment & Fabrication Procedure

G4070 - Consultants

- Covers compensation for consultants or individuals providing services (evaluators, mentors, etc.).

- Faculty Consulting Within Home Department:

- Faculty are expected to consult as part of their University appointment.

- Additional compensation is allowable only if:

✔ The work is across departmental lines or in a separate/remote operation.

✔ The work is in addition to regular responsibilities.

✔ It is explicitly approved in the Federal award or by the Federal awarding agency.

G4082 - STEM Tuition

- Covers tuition remission for Science & Engineering Doctoral Research Assistants at UTA.

- Charged in direct proportion to grant-funded student appointments.

- Eligibility is not affected by grant/contract expiration during a semester.

- UTA STEM Policy

G4090 - Other Direct Costs

- Includes:

- Materials & supplies (<$5,000) (e.g., lab supplies, chemicals, reagents)

- Professional services/fees (e.g., external company/lab services).

- Animal costs, computer services.

- Conference registration fees.

- Incentives for human subjects.

- Publication fees, samples, and other project-related operational costs.

- Excluded: General costs that are not directly assignable to the project and are used across multiple activities.

G4100 - Rentals & Leases

- Covers building and space rentals.

G4105 - Rental Equipment

- Includes equipment rentals (e.g., copiers, printers).

- Must be included and approved in the awarded proposal.

G4110 - Travel (Domestic)

- Covers travel within the United States, including airfare, per diem, and meals.

- Travel must be scheduled through the UTA Travel Office.

- Must be clearly related to project objectives and detailed in the Budget Justification.

G4120 - Travel (Foreign)

- Covers travel outside the U.S., including Canada and Mexico.

- Some agencies require prior approval for foreign travel.

- Must comply with the Fly America Act for federal awards.

- Fly America Act – UTA Policy Section 6

G4130 - Participant Expenses

- Covers costs for workshop, conference, or training participants (e.g., students, scholars, teachers).

- Includes: Housing, meals, travel, registration fees.

- Excludes: PI/staff expenses, consultant travel, speaker fees, event facility rental.

- Federal Restriction: Participant support funds cannot be re-budgeted for non-participant use without prior written sponsor approval.

G4135 - Participant Stipend

- Covers stipends paid to participants in a sponsored project.

- Federal Restriction: Cannot be re-budgeted for non-participant use without prior sponsor approval.

G4140 - Scholarships & Fellowships

- Competitive student awards that are not compensation for project work.

- Allowable only if the Federal award is specifically for training.

- Reference: 2 CFR §200.466 – Scholarships and Student Aid Costs

G4150 - Tuition & Fees (Student Support)

- Covers non-STEM tuition expenses.

- Generally requires prior agency approval.

G4160 - SUBK < $25K

- Covers the first $25,000 of each subaward/subcontract to external agencies.

G4170 - SUBK > $25K

- Covers the remaining amount of a subaward beyond the first $25,000.

- Why split? Indirect Costs (IDC) apply only to the first $25,000 per subaward per the UTA Modified Total Direct Cost (MTDC) base.

G4180 - Facilities & Administrative (F&A) Costs

- Indirect cost line – budgeted per UTA negotiated rate or sponsor restrictions.

- Charged proportionally as direct costs are incurred.

- UTA F&A Rate Agreement

UT SHARE

Please contact your department administrator if you do not have the appropriate UT Share access to view any of these fields

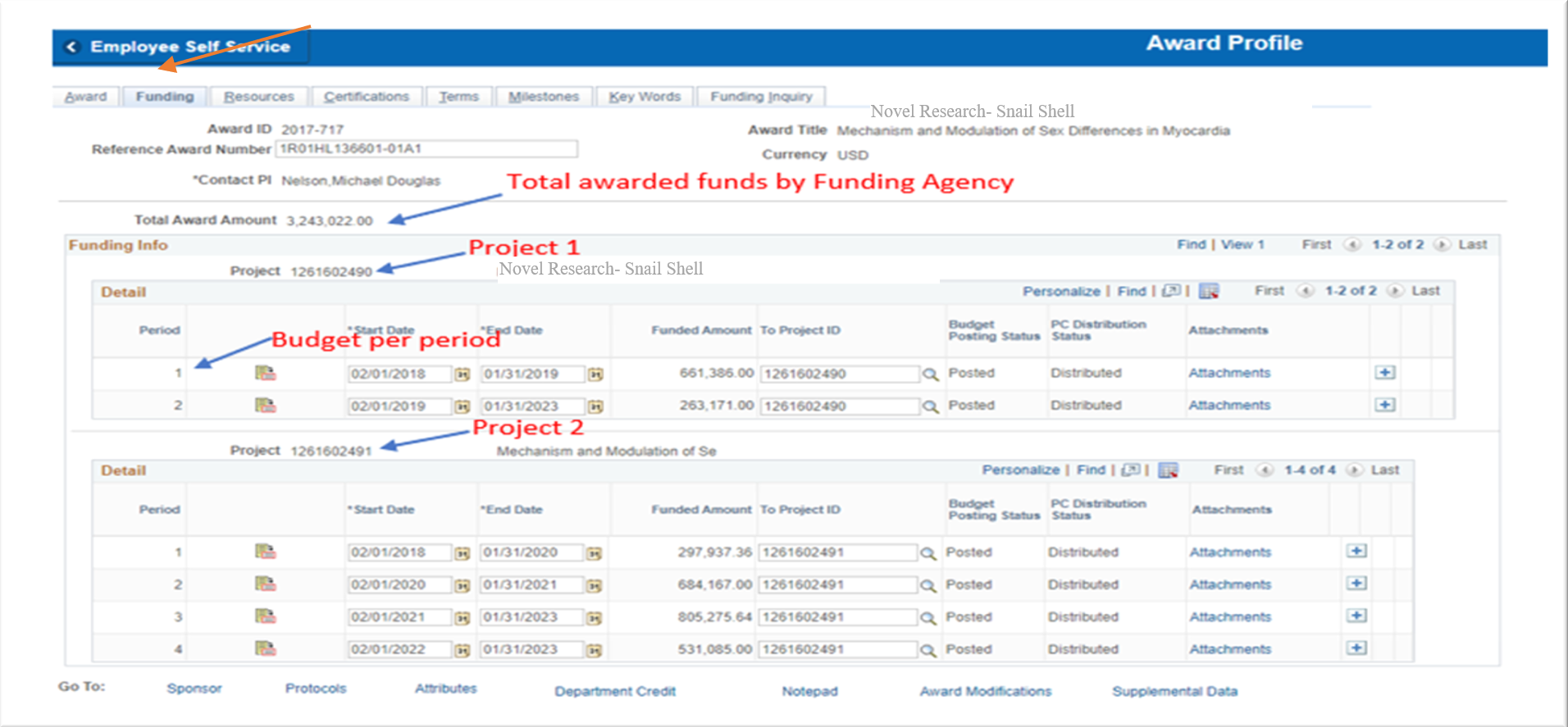

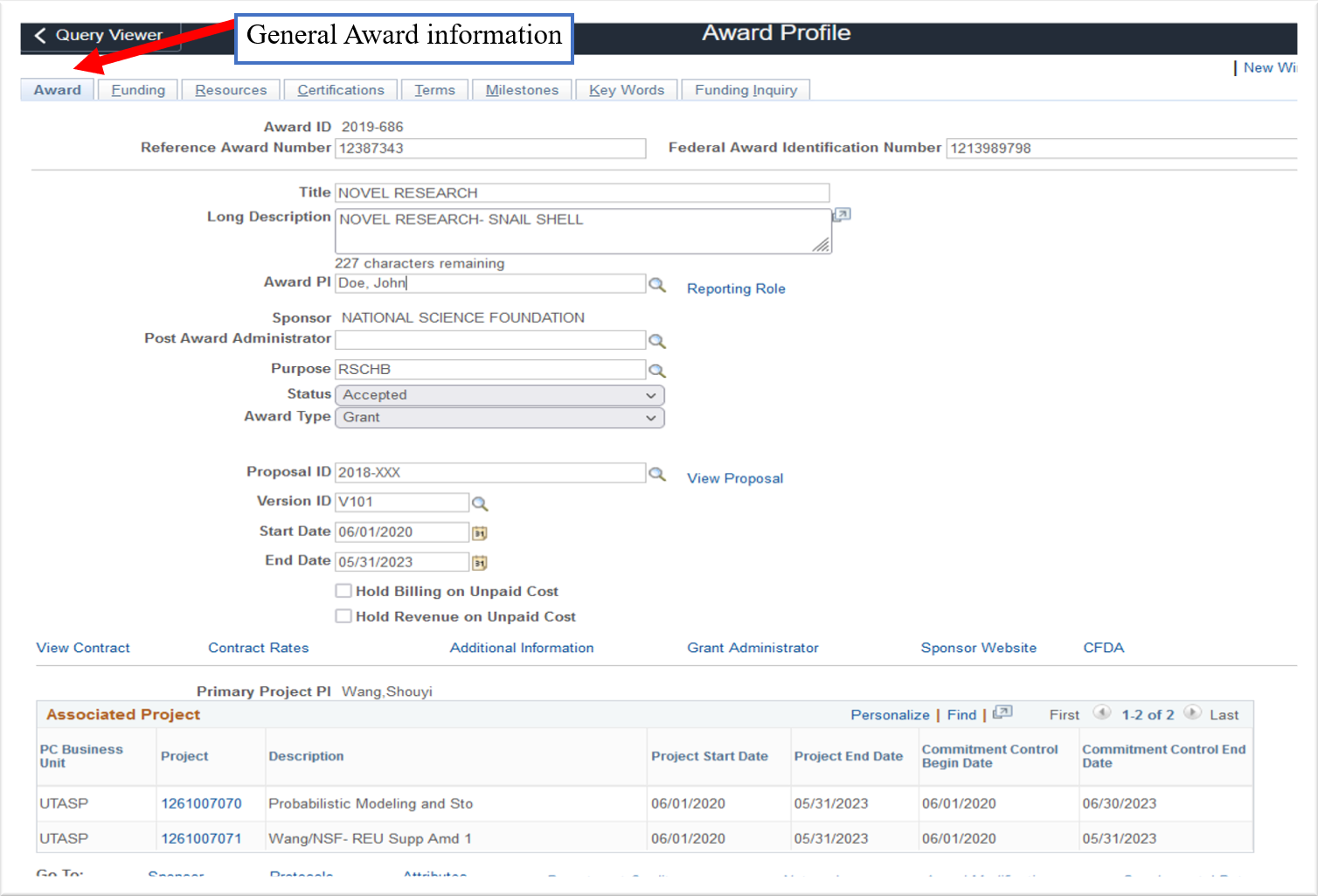

Award Profile

The award profile provides a general overview of the sponsored project and shows the summary information on the award such as:

- Award ID (GCS No.), Reference award Number, FAIN No.

- Project title, Award PI, Sponsor, Purpose, Status of Award (Accepted, closed pending, hold, etc.)

- Award type (Grant, subcontract, MOU, agreement, etc.)

- Award Start, and End Date

- Associated projects with Period of performance (POP)

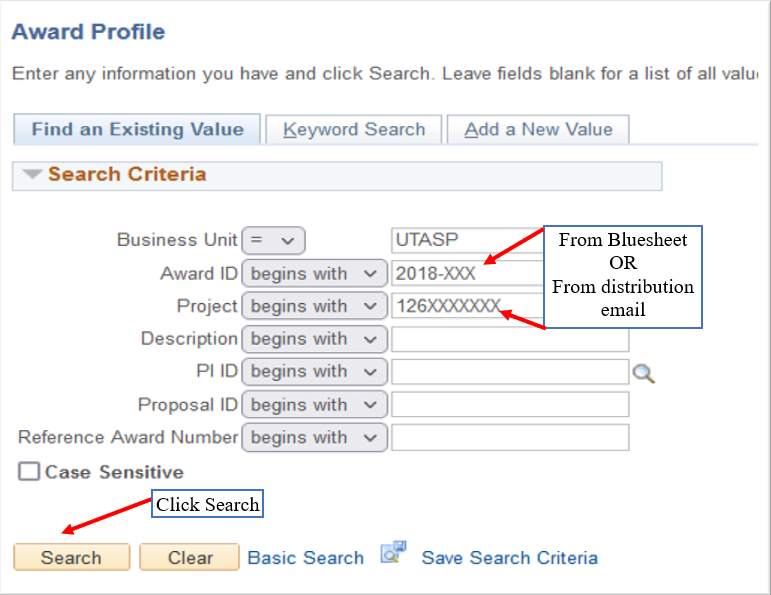

Users can also navigate to the 'Funding' tab to view the Project/Funding breakdown. The navigation is as follows:

- PI Logs into UT Share via the UTA website at https://www.uta.edu/utshare

- Once logged, PI can navigate to the Award profile page in UT Share

- Navigation > Menu > Financials > Grants > Awards > Award Profile

Commitment Control- Review Budget/Balances

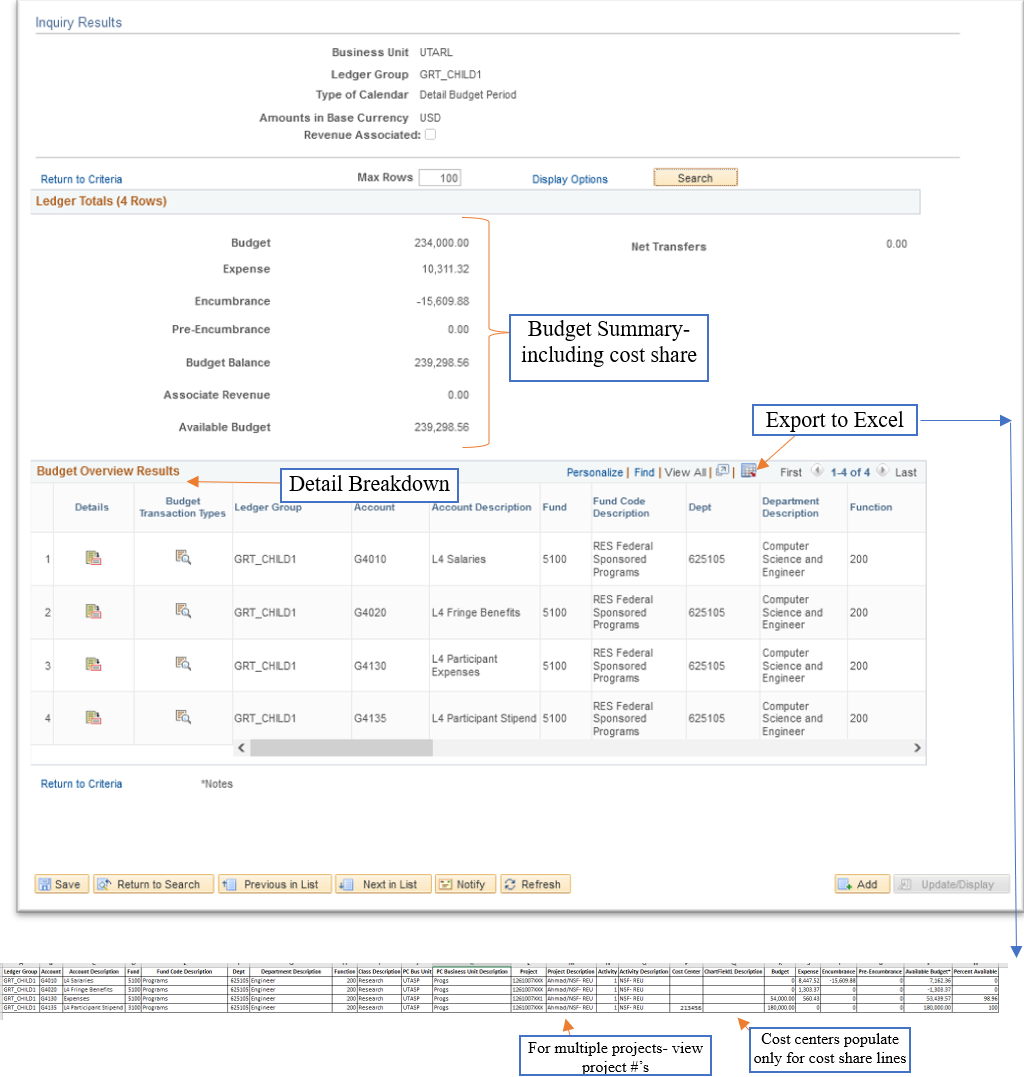

Budget Overview

- To access PI budget, expenditures, and available balances on Award:

- Navigation: PI Logs into UT Share via the UTA website at https://www.uta.edu/utshare

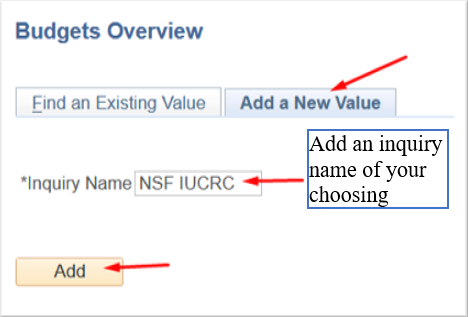

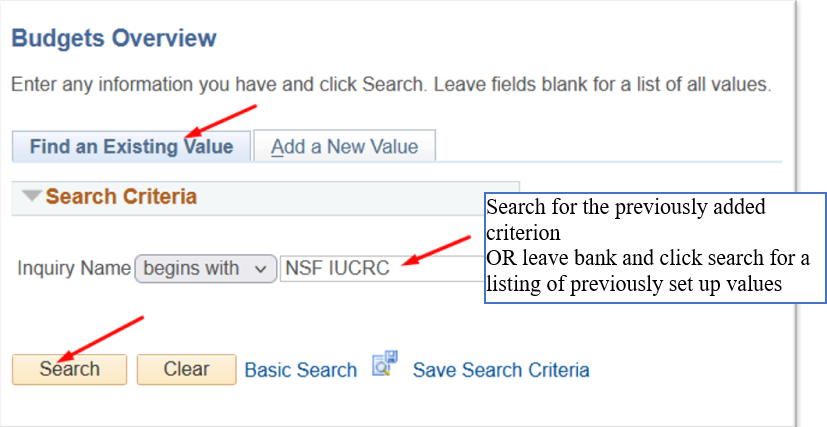

- First time Access - if this is the first time you are accessing, click Add a New Value

- Returning Access - if you have already set up a search criterion, click Find Existing Value

- Search Criteria

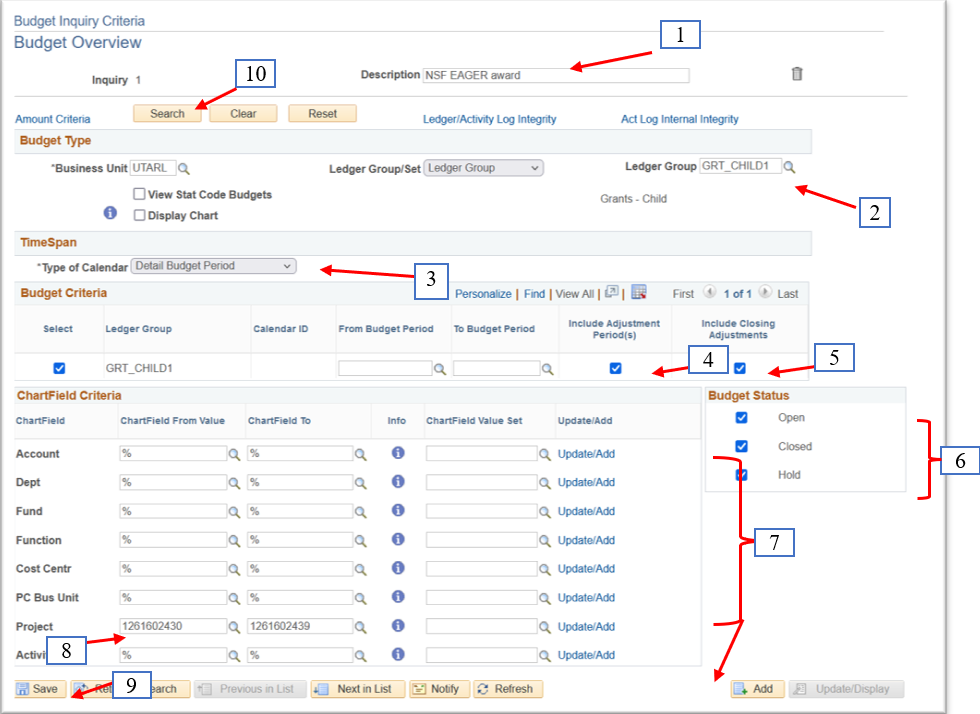

- Enter Description

- Select ‘GRT_CHILD1’ under Leger Group

- Select ‘Detail Budget Period’ under Type of Calendar

- Check the box for Include Adjustment Period

- Check the box for Include Closing Adjustments

- Check the Open, Closed, and Hold box under Budget Status

- % Fill all Chartfield Criteria except Project

- Enter Project Range- Projects must be consecutive- for single project search enter same project in both From and To value

- Click ‘Save’

- Click ‘Search’

- Inquiry Results will populate

- Overall budget summary shows Budget, Expenses, Encumbrances, Available Balance - Please note that these amounts include any Cost Share set up under the associated projects

- Detail is reflected below - Click Download to Download to Excel for easy viewing and sorting

- Cost Share lines will have cost share cost center in the Cost Center column - the Cost center column will be blank for the Sponsor awarded (non cost share) lines

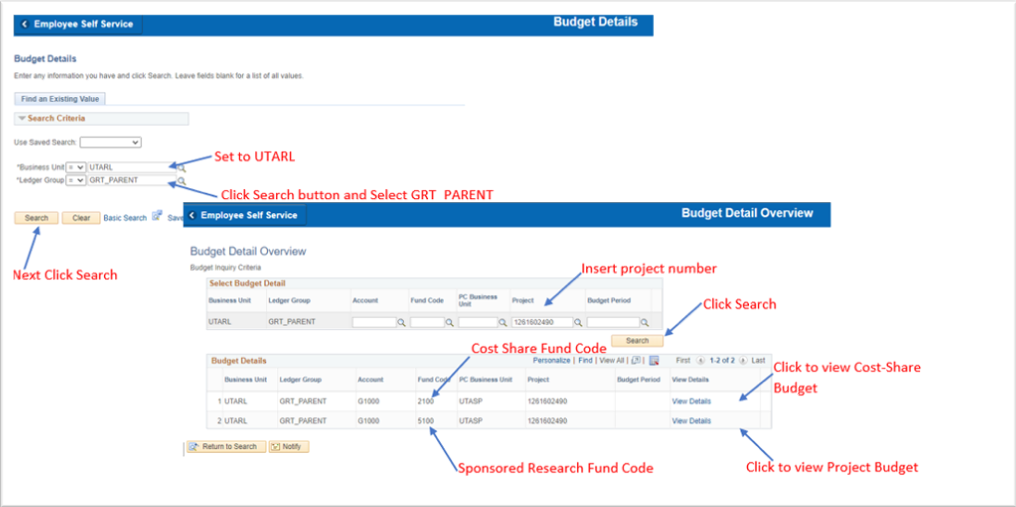

Budget Detail

Budget Detail is another way to view your balances. Under Budget detail project you can only view one project at a time. Associated cost share also has to be pulled up separately.

- Navigation: PI Logs into UT Share via the UTA website at https://www.uta.edu/utshare

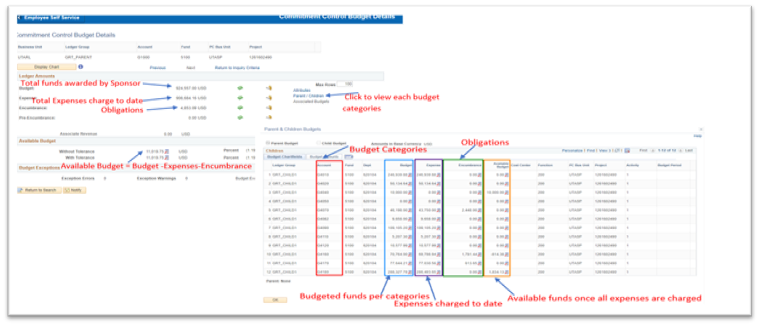

UT Share budget categories for projects

To assist PIs in monitoring awards, the PostAward Specialist provides an analysis every six months from the project start date and a final report analysis within 30 days after project completion.

SPA Process

- The email notification requests that the PI review all expenditures to ensure they are allowable, allocable, and appropriately recorded.

- The email includes a link to payroll reports from Mentis, if applicable.

- Attached to the email:

- Project expenditure analysis and remaining balances.

- Red flag items requiring the PI’s attention.

- Detailed breakdown of:

- Budget, expenses, encumbrances, and remaining balances.

- Cost-share expenses (if applicable).

- Notes and action items for the PI.

- Reporting requirements and status requests on any overdue reports

- The PI and their department administrators are copied on the email.

- If a project includes Co-PIs, both the Co-PI and their department administrators are copied as well.

SPA Red Flags

- Burn Rate: The speed at which funds are spent.

- Slow Spending / Underspending:

- Expenses are low compared to the awarded budget and period of performance.

- May indicate that work is not progressing as expected or that the budget was overstated.

- Funding agencies may reduce future increments.

- Negative Balances: Indicates overspending.

- Expenses in Categories with Zero Budget: Expenses posted where no budget exists in UT Share.

- Over-Budget Categories: Expenses exceeding the awarded budget.

- Payroll Concerns:

- Budget allocated, but no payroll expenses posted (zero effort recorded).

- Reduction in effort not properly documented.

- Cost Share Issues:

- Under-committed or zero expenses recorded in the cost-share cost center.

- May indicate cost-share obligations are not being met per award terms.

Action Required by PI

Please carefully review the analysis and address any red flag items or overdue reports that are highlighted in the email. Prompt attention to these items is crucial for ensuring compliance with the terms of the award and avoiding potential issues with funding agencies.

Budget Transfers

Process Overview

A budget transfer is the reallocation of funds from one budget category to another within the same sponsored project. If the PI/Department identifies the need for a budget transfer, then please follow these procedures:

- PI/Department Administrator reviews the available balances in UT Share to ensure there are sufficient funds for the transfer.

- PI/Department Administrator drafts and submits the budget transfer request to postaward@uta.edu.

- Required Information:

- Dollar amount of the transfer

- From and To category (G4XXX)

- Justification explaining the programmatic need for the transfer (i.e., why the transfer is necessary and allocable to the project’s Scope of Work)

- PI must be CC’d on all requests.

- Required Information:

- PostAward reviews the transfer request for compliance with sponsor guidelines and may request additional information if necessary.

- PostAward facilitates prior agency approval if required.

- PostAward approves the transfer if appropriate and forwards it to GCA for processing in UT Share.

- Transfers requiring sponsor approval are processed by PostAward.

- GCA requires the completion of budget transfer templates for processing on their end.

Red Flags / Considerations:

- Budget transfers should not be requested for the sole purpose of spending down a remaining balance.

- Budget transfers cannot be completed:

- Between projects with different awards/funding allocations

- Between projects and cost centers

- Between projects and the designated cost-share cost center

- When reallocations are requested, it is essential to review the entire project for potential needs.

- Requests must include clear and specific justification; generic or cookie-cutter justifications will not be accepted.

Cost Transfers

Process Overview

A cost transfer is the reallocation of costs from one project to another. If the PI/Department identifies the need for a cost transfer, please follow these procedures:

- PI/Department Administrator reviews available balances in UT Share to ensure sufficient funds are available in the appropriate budget category to facilitate the transfer.

- PI/Department Administrator drafts and submits the cost transfer request to postaward@uta.edu.

- Required Information:

- Explanation of why the expense was charged to the incorrect project.

- Justification explaining how the expense is necessary and directly allocable to the correct project. For salary corrections, confirm that the salary transfer appropriately reflects the Level of Effort (LOE).

- Confirmation that sufficient funds are available to facilitate the transfer and that the expenses occurred during the project’s period of performance (POP).

- If the transfer request is over 90 days:

- Explanation of the delay in requesting the correction.

- Steps taken to prevent such errors and delays in the future.

- UT Share expense detail.

- Required Information:

- PostAward reviews and approves the cost transfer if appropriate, then forwards it to GCA for processing in UT Share.

- Cost transfers over 90 days require additional approval from the Executive Director of OGCS and must include additional documentation to comply with federal cost principles, including documentation of allowability, allocability, and reasonableness.

- GCA requires the completion of a cost transfer template for processing on their end.

Red Flags / Important Considerations:

- Temporarily charging non-allocable expenses to a project with the intention of transferring them later (using projects as holding accounts) is not allowed.

- Transfers to or between sponsored projects for the purpose of spending down balances or clearing negative balances is not permitted.

- Transferring between sponsored projects because the expense was found to be unallowable in one project is prohibited.

- Transfers older than 90 days after the original transaction date require additional justification and documentation.

- Transfers in the last month of the award or after the award has ended require special consideration.

- Cost transfers are for correcting errors and should not be used as a means of managing available cash balances.

- Transfers should be requested and processed in a timely manner. Delays can affect invoicing and payments, potentially leading to disallowed costs.

Unallowable Costs

While there are exceptions, typically, unallowable direct costs include:

- Advertising and public relations

- Advisory councils

- Alcoholic beverages

- Alumni/ae activities

- Bad debt expense

- Collections of improper payments

- Commencement and convocation costs

- Contributions and donations

- Entertainment costs

- Fines, penalties, damages, and other settlements.

- Fundraising and investment management costs

- Lobbying

- Intra-Institution of Higher Education (IHE) Consulting

- Exception: across dept lines

- Losses on other awards or contracts

- Club, social, dining club, or lobbying organization memberships

- Proposal costs

- Meals and travel associated with lobbying, fundraising, alumni activities

- Student activities

- Passports, immigration visas

Please contact postaward@uta.edu prior to charging these expenses to your sponsored projects