Benefits Services

Service Audience:

- New Employee

- Current Employee

- Supervisor

- Faculty

Welcome to UTA Benefits Services

The University of Texas System, Office of Employee Benefits (OEB) works collaboratively with UTA Employee Benefits Services to provide comprehensive benefits and retirement programs for eligible employees, retirees and their dependents. The UTA Employee Benefits Services staff is committed to assisting you in understanding and maximizing the benefits that are offered to you. Stay connected with helpful resources and find all that you will need to get the most out of your plan.

Benefits Services Office Hours: Monday - Friday

- Walk-in Hours: 9:00 am - 12:00 pm

- Appointments: 8:00 am - 5:00 pm

Click Here for a List of Contacts for Benefits Information on Various Topics

Employee Tuition Affordability Program

The UTA Employee Tuition Affordability Program (UTA-ETAP) pays for eligible courses upfront, much like a scholarship. More details can be found on the UTA-ETAP site.

The UTA Employee Tuition Affordability Program (UTA-ETAP) pays for eligible courses upfront, much like a scholarship. More details can be found on the UTA-ETAP site.

Reach out to the Office of Admissions at ashley.jackson@uta.edu to discuss a waiver of the admissions fees.

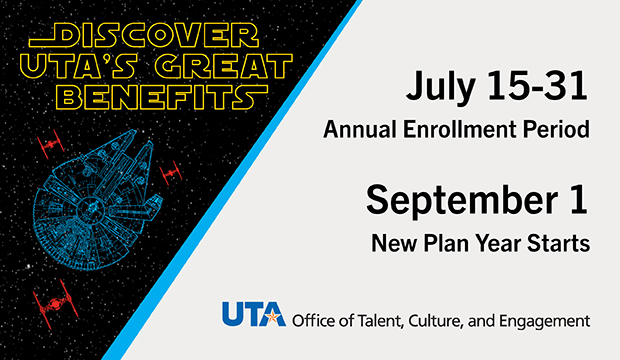

2025-2026 Annual Enrollment

Annual Enrollment Period: July 15th - July 31st, 2025

New Plan Year Starts: September 1, 2025

Visit https://GO.UTA.EDU/BENEFITSAE for more information

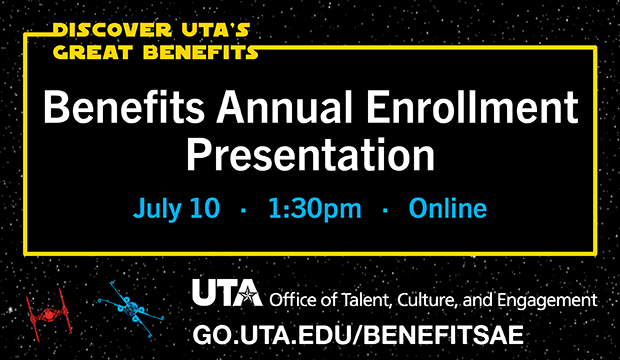

Benefits Annual Enrollment Presentation

Date: July 10, 2025

Time: 1:30 PM

Visit go.uta.edu/hrtraining for more information and to register for the online event.

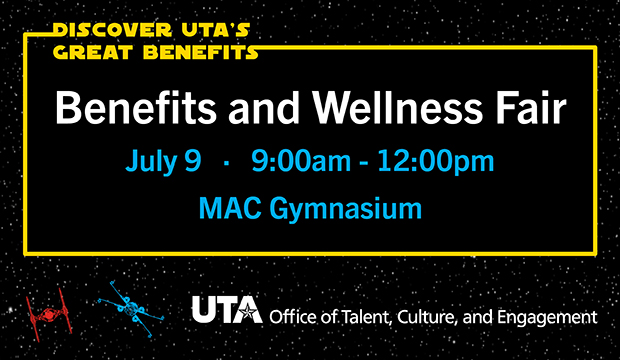

2025 Benefits and Wellness Fair

Date & Time: July 9th, 2025 - 9:00 AM - 12:00 PM

Location: MAC Gymnasium

UT Southwestern Continues as an In-Network Provider for UT SELECT™, SHIP, and UT CARE™

April 1, 2025

BCBSTX contracts with Southwestern Health Resources in North Texas expired on April 1, 2025. However, UT Southwestern will continue as an in-network provider for UT SELECT™, SHIP, and UT CARE™.

This is for UT Southwestern only, and not Texas Health Resources.

BCBSTX has detailed information about their negotiation with Southwestern Health Resources. Members continue to have access to in-network doctors and hospitals throughout North Texas. Check for options based on your plan:

- Visit bcbstx.com and select Find Care to view the online provider directory

- Log into Blue Access for Members℠ or their online member portal

- Call the customer service number on your member ID card

BEGINNING SPRING 2025

UTA Employee Dependent Scholarship (UTA-EDS)

For current full-time employees' eligible dependent children or spouses

- Flat dollar amount of $500 per semester

- Recipients must pay any remaining balance

- Must be used for attendance at UTA

Visit GO.UTA.EDU/EDS to learn more.

GTA & GRA Benefits Orientation - Spring 2025

Virtual:

Virtual:

Wednesday, February 4th 2025 at 1:00 PM

New Benefit Plan Year Starts September 1, 2024

New selected benefits, benefits plan designs, and benefits premium changes take effect on Sunday, Sept. 1. Remember to check your October 1st paycheck to verify the benefits coverage and deductions are correct. If you have questions about any changes, visit the Benefits Annual Enrollment website.

UT Flex FSA Deadline Reminders

- August 31, 2024, is the last day to incur UT Dependent Day Care Flexible Spending account qualifying expenses, for active employees with active accounts for the 2023-2024 plan year.

- November 30, 2024, is the UT Flex Health Care and Dependent Day Care claim filing deadline for the 2023-2024 plan year.

If you have any questions regarding UT Flex FSA, please contact Maestro Health at (844) UTS-FLEX (887-3539) or questions@maestrohealth.com or contact Benefits at benefits@uta.edu or 817-272-5554.

GTA & GRA Benefits Orientation - fall 2024

In Person:

Wednesday, September 4th, 2024 at 2:30 PM

Lone Star Auditorium, located in the MAC (Maverick Activities Center)

Virtual:

Wednesday, September 11th, 2024 at 1:00 PM

2024-2025 Annual Enrollment

2024-2025 Benefits Annual Enrollment

Benefits Annual Enrollment is from July 15th - July 31st. If you wish to make any insurance changes you MUST do so between July 15 and July 31, 2024, for the plan year beginning September 1, 2024. More information can be found on the Benefits Annual Enrollment Website.

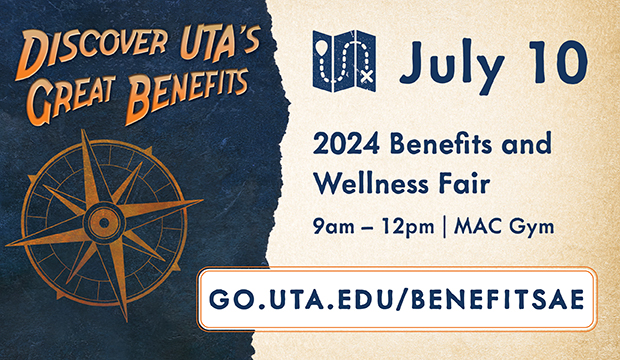

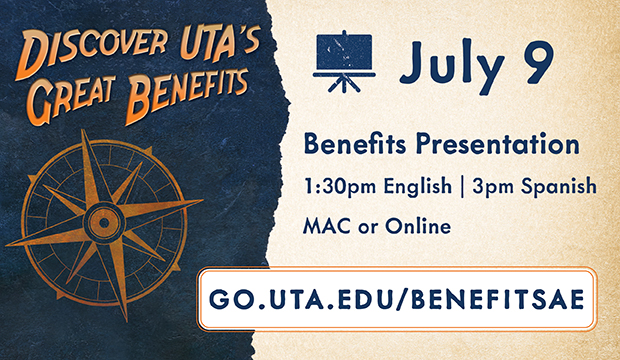

2024-2025 Benefits Presentation/ Benefits and Wellness Fair

2024 Benefits and Wellness Fair - July 10

9am - 12pm | MAC Gym

2024 Benefits Presentation - July 9

1:30pm English | 3pm Spanish

MAC Gym

GTA/GRA Benefits Orientation - Spring 2024

Virtual Event: January 31, 2024 at 1:00 PM

GTA and GRA Benefits Orientation - Fall 2023

In person: Wednesday, September 6, 2023 at 4pm in the Lone Star Auditorium, Located in the MAC

In person: Wednesday, September 6, 2023 at 4pm in the Lone Star Auditorium, Located in the MAC

Virtual: Wednesday, September 13, 2023 at 1pm.

Benefits Eligibility, effective date, Premiums Sharing & Rates

Full-Time Employment

Employees are eligible for benefits as a full-time employee, the first day of employment if:

1) You work at least 40 hours per week or have a full-time appointment,

2) Your appointment is expected to continue for at least 4 ½ months,

3) You are eligible to participate in TRS or ORP, and

4) You are not currently insured by another state-sponsored medical insurance plan.

Part-Time Employment

Employees are eligible for benefits as a part-time employee, the first day of employment if:

1) You work at least 20 but less than 40 hours per week, or have at least a 50% appointment,

2) your appointment is expected to continue for at least 4 ½ months,

3) you are eligible to participate in TRS or ORP, and

4) you are not currently insured by another state-sponsored medical insurance plan.

You may enroll your eligible dependents for certain benefits coverage.

Eligibility to participate in certain UT Benefits coverage as a dependent is determined by law.

Eligible dependents are:

- Your spouse

- Your children under age 26 regardless of their marital status, including: biological children; stepchildren and adopted children; grandchildren you claim as dependents for federal tax purposes; children for whom you are named a legal guardian or who are the subject of a medical support order requiring such coverage; and certain children over age 26 who are determined by OEB to be medically incapacitated and are unable to provide their own support.

Examples of dependents that are not eligible for UT Benefits include:

- Your former spouse

- Foster children covered by another government program, unless coverage is required by law or court order.

- Any dependent insured in the same plan type by another UT employee or retired employee; or any dependent insured by another plan that receives State of Texas premium contributions

OVERAGED INCAPACITATED DEPENDENTS

A dependent child age 26 or older who is determined to be medically incapacitated at the time a subscriber first becomes benefits eligible may be enrolled in the plan if the child was covered by the subscriber’s previous health plan with no break in coverage.

Enrolled children may be eligible for UT Benefits as an incapacitated dependent if they are determined to be medically incapacitated at the time they age out of eligibility for coverage as a child under the program at age 26.

For overaged incapacitated dependents, proof of other current coverage, an application for coverage, including medical files documenting incapacitating condition and dependency must be submitted within 31 days of initial eligibility for enrollment of an incapacitated dependent. Following receipt of this information, a review of all applicable materials will determine if the overage dependent is eligible for coverage in the UT Benefits program.

SURVIVING DEPENDENT BENEFITS

A surviving spouse or other benefits-eligible dependent may continue limited participation in the UT Benefits program following the death of a participating employee or retired employee, provided the employee has at least five (5) years of creditable service with either Teacher Retirement System of Texas (TRS) or the Texas Optional Retirement Program (ORP), including at least three (3) years as a benefits-eligible employee with UT System.

A surviving spouse may only continue UT Benefits Medical, Dental, or Vision coverage they are enrolled in at the time of the employee’s or retired employee’s death. They may not add coverage at that time, and if the coverage is ever dropped or terminated for any reason, it may not be reinstated. Surviving dependents are not eligible for Premium Sharing. Coverage may continue for the remainder of the surviving spouse’s life. A dependent child may continue until the child loses his or her status as a dependent child. The dependent of an individual who has not met the service requirements at the time of death may elect COBRA coverage for a period not to exceed 36 months.

DEPENDENT DOCUMENTATION

UTA requires supporting documentation when you request to add a dependent to your plan. Be prepared to provide proof of eligibility such as your marriage certificate, your children’s birth certificates, appropriate adoption paperwork, federal tax forms or other documents that support the dependent relationship.

Required documents must be uploaded directly for review and approval using My UT Benefits.

For a list of required documents for dependents, click here.

New Employee Benefits Coverage may become effective at the Employee’s Option on either:

- The first day of active employment in a Benefits Eligible position. Please note that monthly premiums for the coverage are not pro-rated. An entire month’s premium must be paid for the first month of coverage regardless of the day on which the coverage becomes effective during the month. Based on the timing of your enrollment and our payroll processing deadlines, your first paycheck following your enrollment may or may not reflect the benefits premium deductions. If you don’t see your insurance premiums on your first paycheck, please note your second check may be double deducted. This option is the My UT Benefits New Employee Coverage Default effective date.

Or

- The first of the month following the first day of active employment in that position. To elect this option, please contact Benefits Services.

All employees are encouraged to thoroughly review your earnings statement for accuracy and immediately contact Benefits Services for any discrepancies.

Premium Sharing refers to the funds contributed by the State and UT Arlington to pay for some or all of the cost of the Basic Coverage Package (Medical, Basic Life and Basic AD&D insurance for employees).

Premium Sharing Amounts

The amount of Premium Sharing depends on your employment appointment, and in most cases is:

For full-time employees: 100% of employee premiums for the basic coverage package and 50% of the premiums for your dependents’ medical coverage.

For benefits-eligible part-time employees: 50% of employee premiums for the basic coverage package and 25% of the premiums for your dependents’ medical coverage.

If you are a part-time employee who is eligible for benefits because of your status as a graduate student, UT and the State of Texas will pay 50% of your premiums for the basic coverage package, and up to 25% of the premiums for your dependents’ medical coverage.

If you are a benefits-eligible employee with coverage under another group health plan and elect to waive the basic coverage package, you are eligible to use state premium sharing (50% if you are full-time and 25% if you are part-time) to purchase one or more of the following optional coverages that are paid on a pre-tax basis: Dental, Vision, and Voluntary Accidental Death and Dismemberment (AD&D). If you waive, you will not be enrolled in Basic Group Life Insurance or Basic Accidental Death and Dismemberment (AD&D) insurance.

Important: Those who wish to waive the Basic Coverage Package and receive partial Premium Sharing for eligible optional coverages, must submit proof of other group health insurance to UTA Benefits Services.

Enrollment & Changes

Retirement

UTA offers various tools and resources to maximize your retirement benefits. The information below can help you manage your retirement plans, increase your savings, and make the best decisions for your financial future.

Resources

- Medical - Blue Cross and Blue Shield BCBS UT Select

- Medical – UT Select Hinge Health

- Medical – UT Select Omada Health

- Medical – UT Select Livongo

- Prescription Drug Plan – Express Scripts

- Dental – Delta Dental UT Select Dental

- Vision – Superior Vision

- Group Term Life, AD&D, and Disability – Blue Cross and Blue Shield (BCBS)

- Flexible Spending – Maestro Health, is now a part of Marpai, Inc. - UT Flex

- Wellness – Limeade Living Well Health Program

- Retirement Manager

MYUTBenefits (Benefitplace app) iPhone or Android

Medical - Ovia Fertility – Health & Fertility Ovia

Medical - Ovia Pregnancy – Pregnancy & Postpartum

Medical - Ovia Parenting – Family & Working Parents

- Managing your Benefits

- Get an ID Card

- Find a Provider or Pharmacy

- Self-Care Resources

- Parenting & Family Support

- Medicare - Active Employees

- Tobacco Premium Program

- Retirement Benefits Resources

- TSA Limit Calculators

- UT Saver DCP Special Catch-Up Calculator

- Benefits While you Travel

- Pregnancy and Breastfeeding Resources

- Benefits Glossary

- Video Library

- Behavioral Health Network

- Benefits Documents

- Traditional vs. Roth Options: Choosing the Best Path

- Federal Tax Savers Credit

- Retirement Resources

- UT System Voluntary Savings Plans – Why should I participate?

- UT Retirement Resources

- UT SELECT Health Advocate FAQs

- Health Advocate